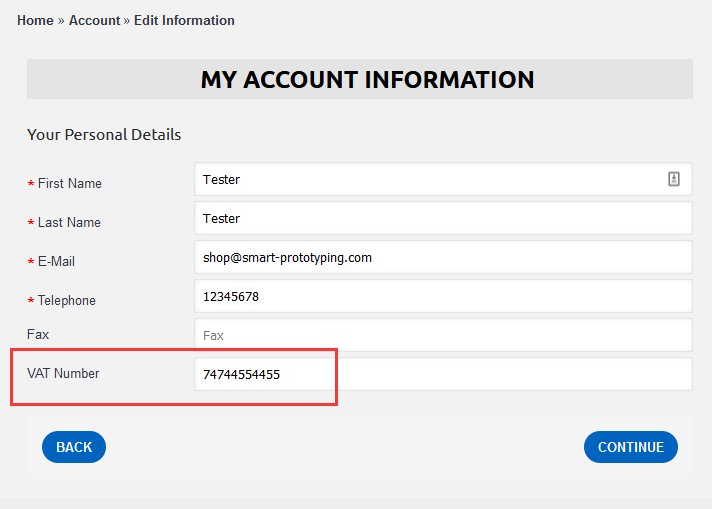

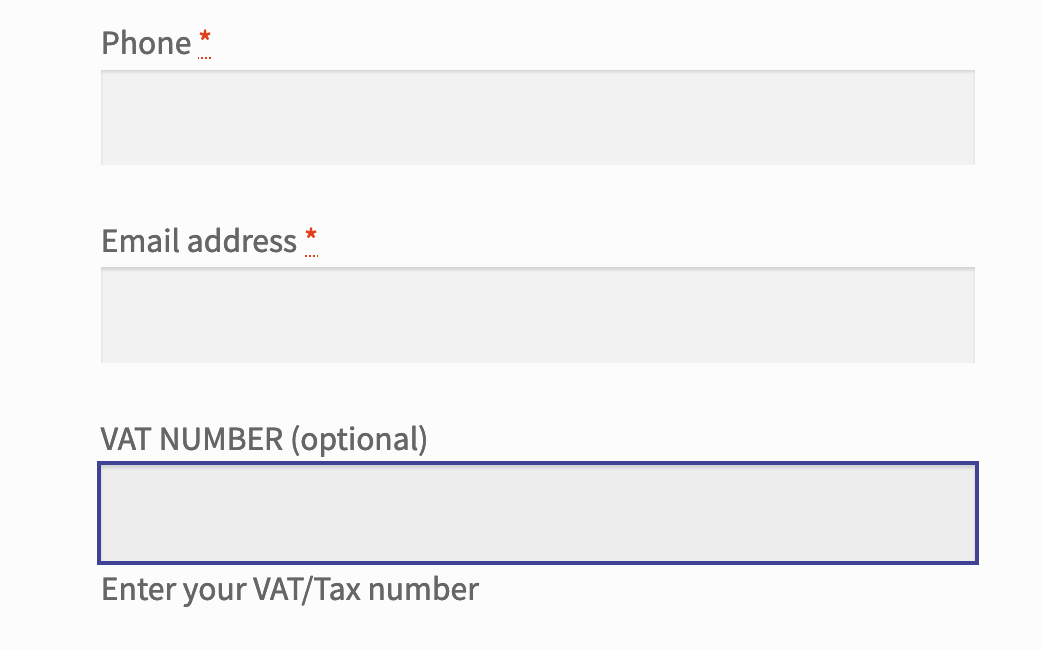

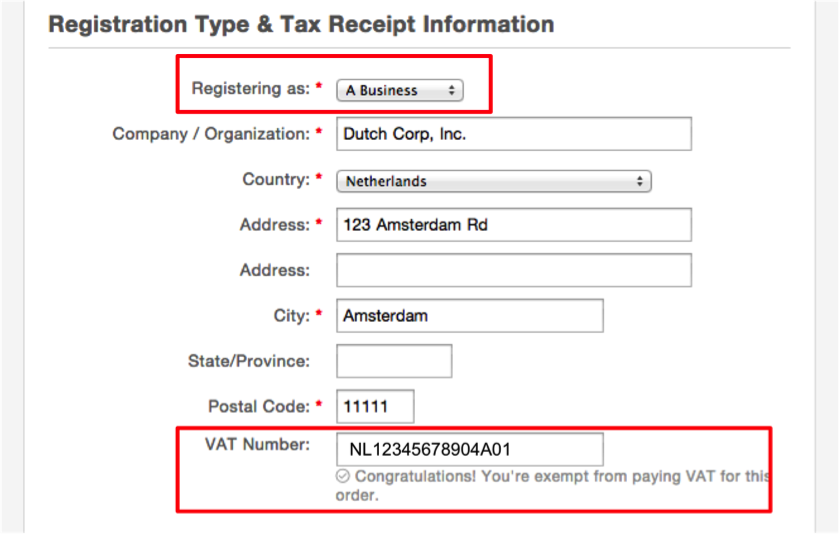

Phone Number and VAT Number Field Updates

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool. The search result that is displayed within the VIES tool can be in one of two ways; EU VAT information exists ( valid) or it doesn't exist.

How to find a business's VAT number? Experlu

Rates of Value Added Tax (VAT) in Portugal. In Portugal, there are three rates of Value Added Tax (VAT): a reduced rate of 6% in mainland Portugal, 4% in the Autonomous Region of the Azores and 5% in the Autonomous Region of Madeira for goods and services in List I of the Value Added Tax Code. an intermediate rate of 13% in mainland Portugal, 9.

VAT Number The Ultimate Guide Bansar China

The first 9 digits are the SIREN number and the following 5 digits are the NIC number ( Numéro Interne de Classement ). The SIRET number provides information about the location of the business in France (for established companies). More info (in French) can be found in this website of the French authorities. The EU VAT number must be used for.

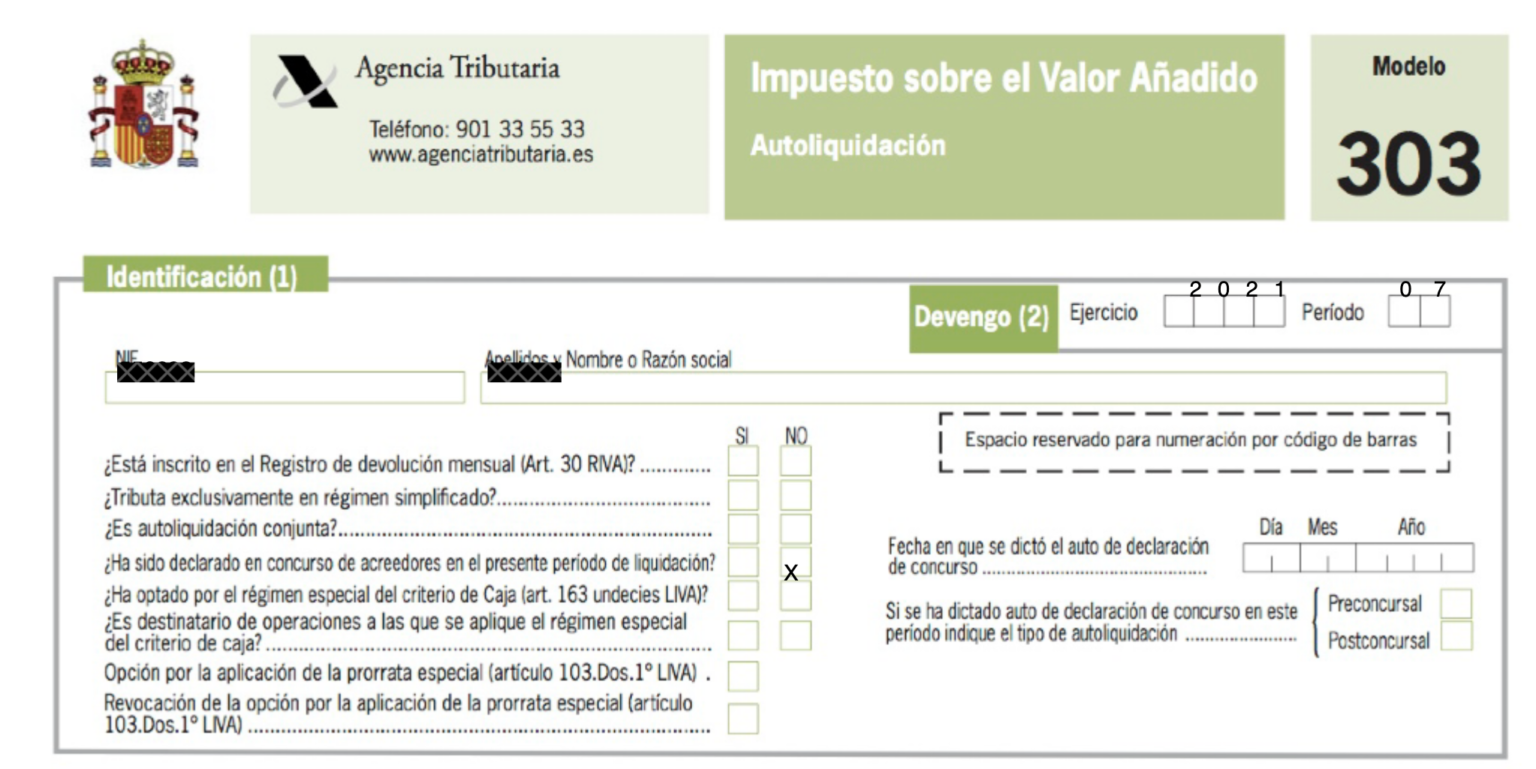

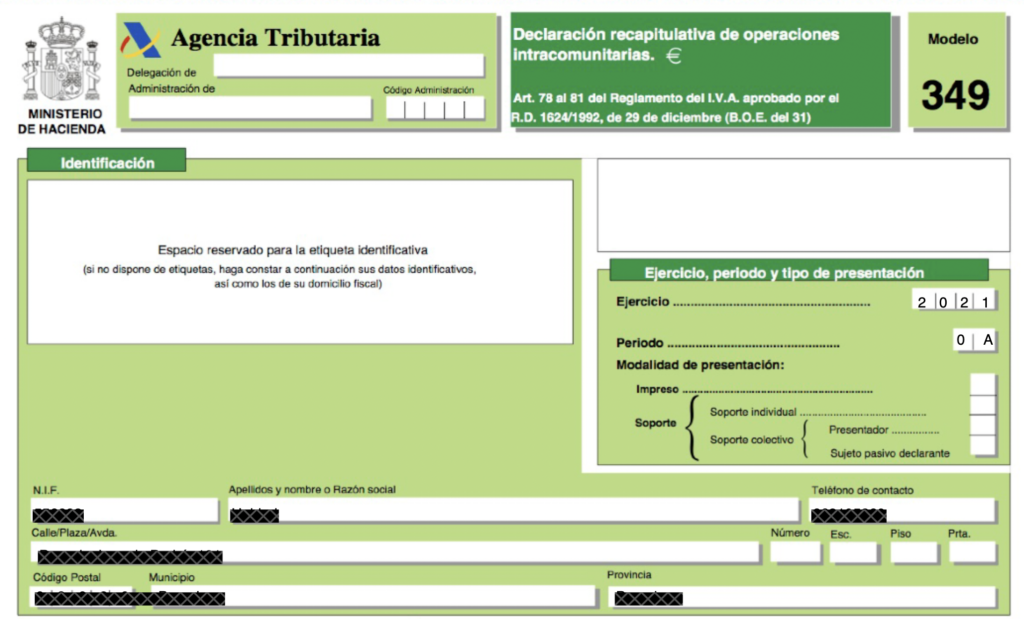

Número VAT ¿Qué Es y Cómo Se Tramita? Holded

O que é o VIES? O VIES (Sistema de Intercâmbio de Informações sobre o IVA) é um motor de pesquisa (e não uma base de dados) da Comissão Europeia. Quando se faz uma pesquisa com a ferramenta VIES, os dados são recolhidos nas bases de dados nacionais do IVA.. Por motivos de proteção de dados, as administrações nacionais não.

How do I find my VAT number?

The Value Added Tax, or VAT, in the European Union is a general, broadly based consumption tax assessed on the value added to goods and services. It applies more or less to all goods and services that are bought and sold for use or consumption in the European Union. Thus, goods which are sold for export or services which are sold to customers.

EU VAT Number Plugin —

Thresholds triggering VAT reporting obligations in Portugal. Intrastat threshold at introduction. 350 000 EUR. Intrastat threshold on dispatch. 250 000 EUR. Distance selling threshold. As of 1st July 2021, the threshold is EUR 10,000 for all intra-Community distance sales.

Kira sözleşmesi Vat number nedir

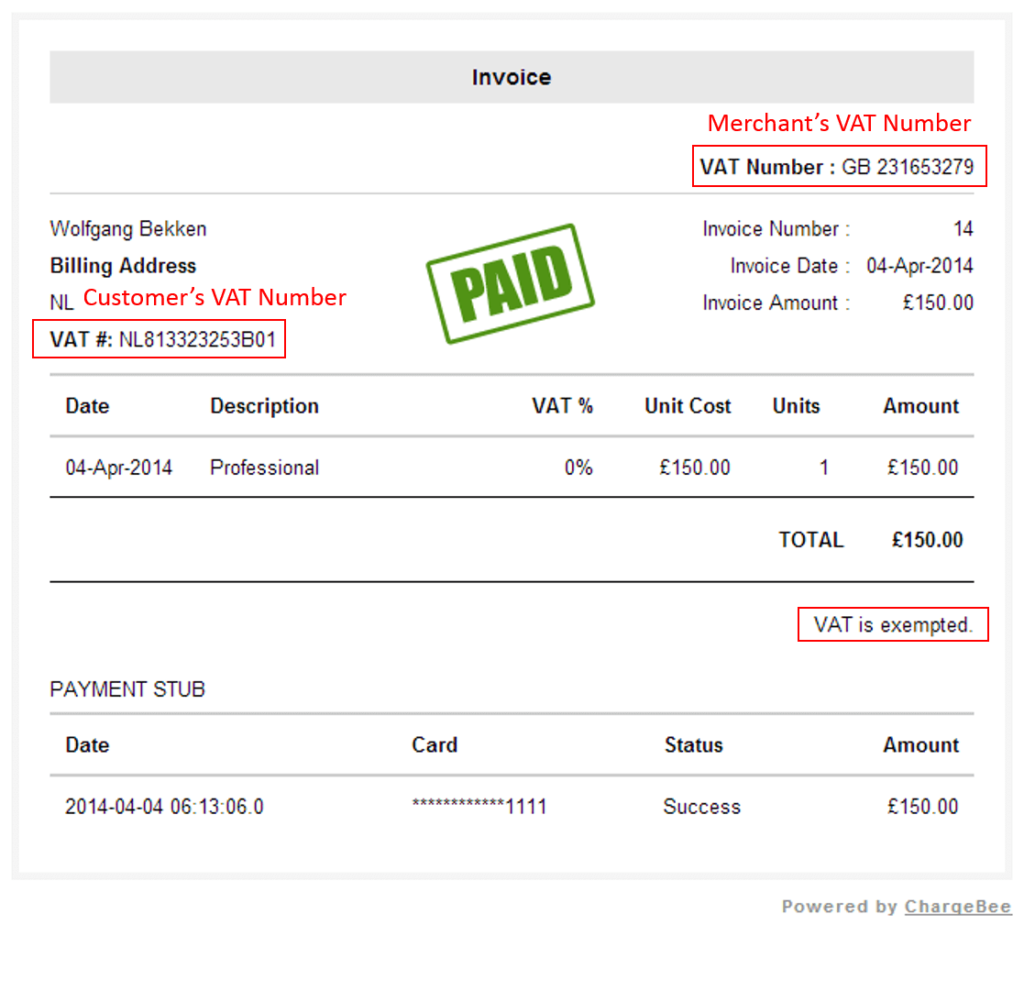

The importance of VAT numbers. Used to identify tax status of the customer. Help to identify the place of taxation. Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that.

How to Add a VAT Number to Your Kinsta Account

O VAT Number é nada mais nada menos que o seu número de contribuinte, ou Número de Identificação Fiscal, ou seja, o NIF. Já VAT é a sigla para Value Added Tax (imposto sobre o valor acrescentado), ou seja, está relacionado com o nosso IVA. Assim, o seu NIF, ou neste caso, o VAT Number, é normalmente pedido para o apuramento de impostos.

Cos'è e come verificare velocemente il VAT number? Gestionale.co

The EU has set a standard minimum VAT rate of 15% for its 27 member countries. The actual VAT rates of the EU countries range between 17% and 27%. Switzerland is not part of the EU and has a standard VAT rate of 7.7%, which is far lower than neighbouring countries. VAT rates differ across European countries.

Número VAT ¿Qué Es y Cómo Se Tramita? Holded

VAT é uma sigla de Value Added Tax - imposto introduzido na Grã-Bretanha em 1973, que corresponde ao ICMS (Imposto sobre Circulação de Mercadorias e Serviços) no Brasil. O VAT é de 17,5%, mas nem todos os produtos estão sujeitos à cobrança. Nesse caso, são chamados de zero-rated.

Admin Guide UK & EU VAT Number Validation

Porém, por mais chato que o assunto seja, é sempre bom saber o que está se pagando de imposto, qual o valor dele e qual a finalidade desse pagamento. As principais características do VAT são as seguintes: trata-se de um imposto de base ampla, que incide sobre os diversos estágios de produção e que — acima de tudo — é cobrado sobre.

วิธีระบุหมายเลข VAT ของ VAT ในสหภาพยุโรปของคุณ สหราชอาณาจักร Carbs คลาสสิก

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website. It confirms that the number is currently.

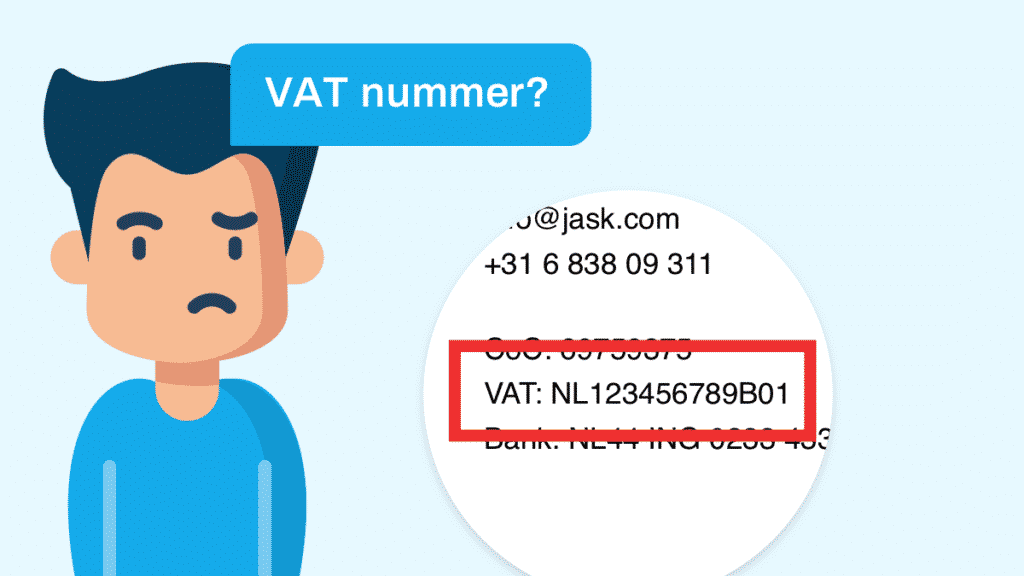

VAT nummer Wat is dat? Voorbeelden Gouden Tips » DeSoftwareVergelijker.nl

VIES VAT number validation. Close . Important Disclaimer: As of 01/01/2021, the VoW service to validate UK (GB) VAT numbers ceased to exist while a new service to validate VAT numbers of businesses operating under the Protocol on Ireland and Northern Ireland appeared. These VAT numbers are starting with the "XI" prefix, which may be found.

How VAT works and is collected (valueadded tax) Novashare

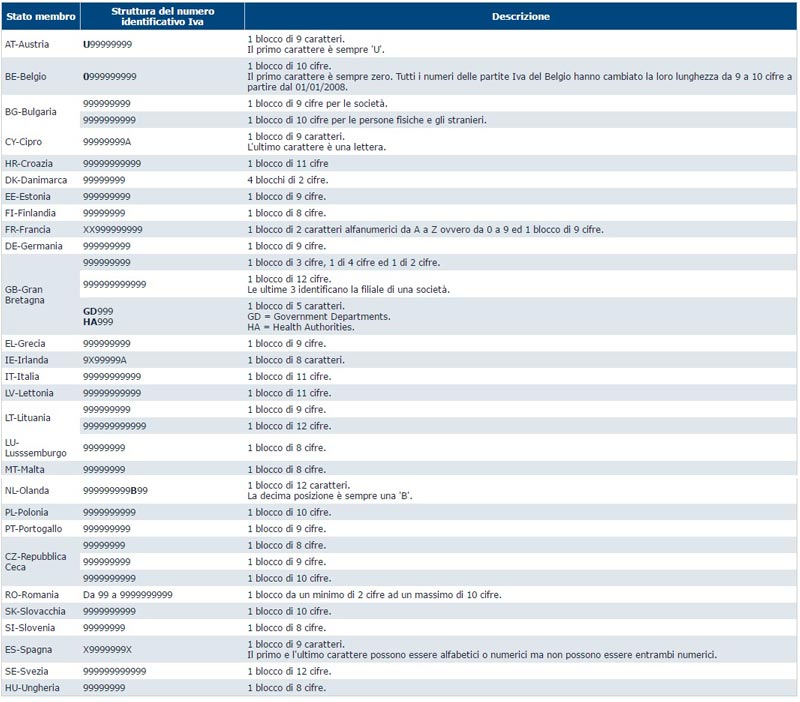

EU VAT number formats. 11 characters May include alphabetical characters (any except O or I) as first or second or first and second characters. 12 characters. The 10th character is always B. Last (ninth) digit is a MOD11 checksum digit. [20] Click for free EU VAT number formats i nfo.

How to find a business VAT number AccountsPortal AccountsPortal

Pelo quase nada que sei sobre este assunto, VAT Number é uma espécie de número de identificação do contribuinte para as operações com a União Européia. Sempre pesquise antes de postar. Visite o meu Facebook. ***CCB. Alex Viana de Souza. Prata DIVISÃO 1, Analista Fiscal. há 14 anos Segunda-Feira | 15 março 2010 | 08:17.

How VAT works and is collected (valueadded tax) Perfmatters

Online. At the counter. Through the tax representative of the person applying for the taxpayer identification number (NIF). Free. The appointment is made at ebalcão , choose the "Appointment" option. The representative will have to authenticate themselves with the Digital Mobile Key, Citizen's Card or Tax Identification Number and password.